[ad_1]

The AXS price risks more losses while its technical setup predicts a 2500% price rally despite the token facing some strong headwinds ahead so let’s read more today in our latest altcoin news.

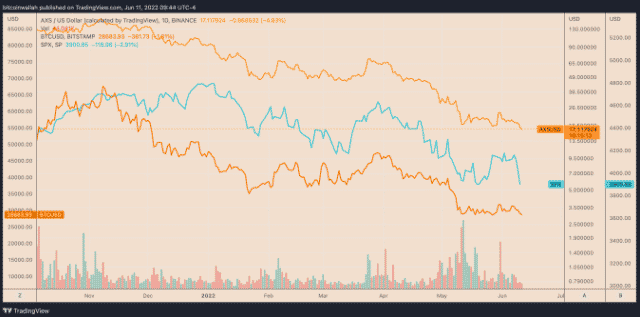

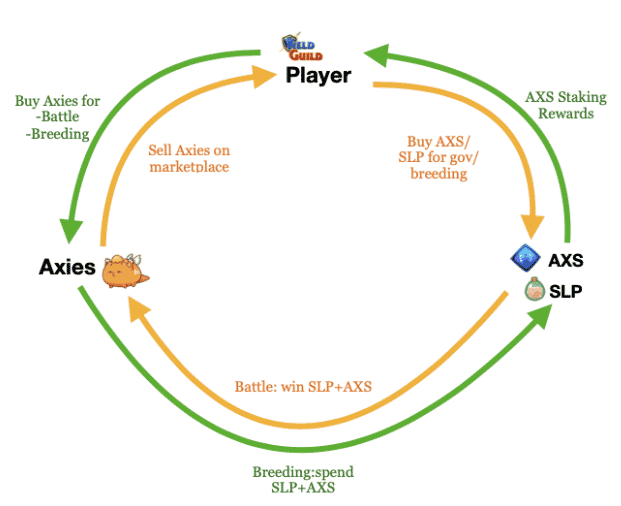

The AXS price risk more losses as it already dropped by 90% from the $172 level in November 2021. AXS sharp correction made it one of the worst performing assets among the top-ranking cryptocurrencies and it can even undergo mroe declines in the upcoming months according to the mix of technical and fundamental catalysts. To recap, AXS serves as a settlement token in the Axie Infinity Gaming Ecosystem and allows players to purchase Native NFTs as a flurry of digital pets dubbed Axies. It acts as a work token that players can use and spend to breed new Axies.

The new users that enter the Axie Infinity ecosystem need Axies to pit them in a battle against other Axies so when they win, the platform rewards them with a native token called Smooth Love Potion and the winning larger tournaments grant them AXS coins. As a result, the old Axie Infinity players rely on the new ones to maintain the demand for the Axies. Otherwise, they can risk old players selling their SLP and AXS earnings in the market which will add more downside pressure to their rates.

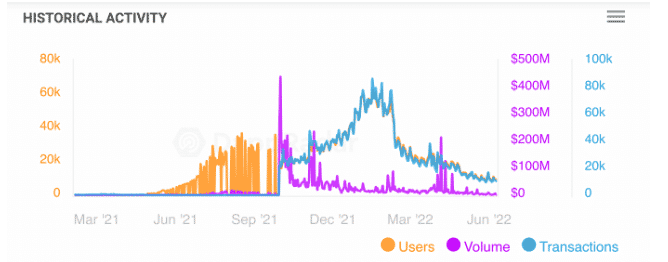

When the valuation of the native token drops, it makes the game less appealing to the new players that still need to pay for the Axies and be able to earn the low-valued SLP and AXS units. The Axie Infinity ecosystem went through a lot of stages and in 2022, with the player count dropping to 8,950 from 63,240 in January, it marked an 85% decline and it coincides with the AXS 80% drop in the same timeframe.

Axie Infinity’s platform volume was measured after assessing the ROnin Chain data and dropped from $300 million to a mere $2.12 million in June 2022. At the same time, the project’s top executives changed their mission statement with a new head of product admitting that Axie Infinity has to be a game first. The inflation now dampened the upside sentiments even more and this also boosted the AXS bearish outlook.

The US consumer price index increased by an annual pace of 8.6% versus the 8.3% in the previous month which only heightened the investors’ fears that the Federal Reserve will be forced to hike the interest rates in the upcoming months which will push the riskier assets lower. AXS dropped 7.5% and then fell again by 7% a few days ago to reach a new low of $16.79.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link