[ad_1]

Terraform labs whales dumped LUNA before the UST peg collapsed in order to make massive profits from the crash according to reports from Arcane Research so let’s read more today in our latest cryptocurrency news.

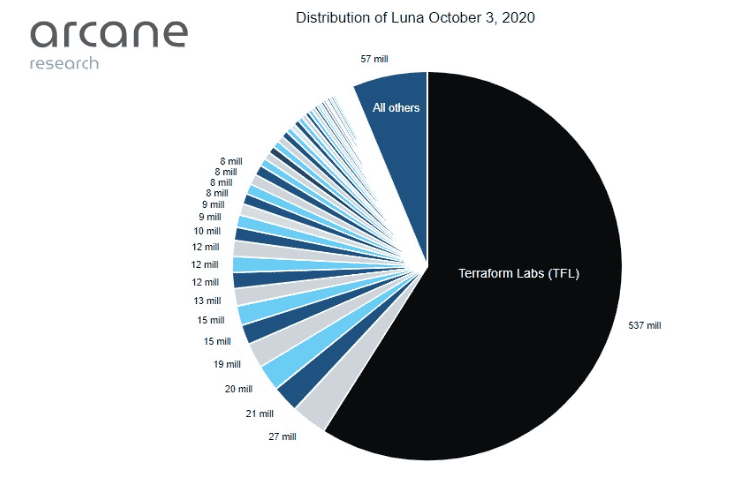

The Senior analyst at Arcane Research Anders Helseth filed an entry recently claiming that Terraform Labs whales dumped LUNA tokens on retail users shortly before the collapse and during the collapse of the UST stablecoin. If the Terra ecosystem is sinking cruise ship, the captain and the guests fled and left most passengers without a lifeboat, reads the post. Helseth tracks down the flaws of the TErra Classic Protocol back to the genesis claiming that “no block rewards and highly concentrated LUNA supply gave power to the early holders. “ Arcane Research shared a pie chart and the analysts claim that the value flows in the ecosystem accounted for transactions up to May 5th to avoid obscurity.

The analysis reveals that the sets of John Doe Wallets that interacted closely in clusters have huge net outflows from the Terra ecosystem to bridges and centralized exchanges. He claimed that there’s a common denominator among the clusters as one or more wallets in the cluster recieved major transfers from Terraform Lab’s wallets. From October 2020 to May 5th, 2020, the clusters comprised net outflows of over $6 billion in bridges and exchanges.

On the other hand, all of the thousands of wallets have a net inflow of $6.5 billion but what’s more, he argued that the clusters deposited huge amounts of LUNA to exchange when the price was low and made outflows that were undervalued relative to the inflows of LUNA. The report details that the algorithm behind UST allowed these LUNA wallets to mint bigger amounts of UST and benefit from the 20% yield on the Anchor protocol. The yield crated the massive demand for UST and provided the exit liquidity for the clusters.

As recently reported, TerraUSD’s crash brought on quite the level of scrutiny on the DEFI financial mechanisms and the feasibility of the algorithmic stablecoins into question. The co-founder of BLOCKV and Tether Reeve Collins said that the UST debacle and Terra’s collapse could bring the end of the algorithmic stablecoins.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link